Hi, my name is Larry Tyler and I'm a fractional CFO and I'm excited. Even more so than most any time in my life. I have just finished the financial intelligence course and let me tell you some things that I learned in the course that I've already put into play. I just finished the course last week and it's making a difference not only for me and my business, but for my clients. I'm teaching my clients and illustrating how they can anchor every decision to the value of their company by freeing up cash flow. This is the most important and most valuable course I've ever taken. It's energizing and it makes simple, makes sepal and common sense.

The CEO Financial Intelligence Program

Control Your Numbers

and Scale Without Losing Control.

A 6 weeks CEO-level program led by Oana Labes, MBA, CPA

- Stop outsourcing financial judgment (and own the outcome).

- See cash pressure and risk months before they hit.

- Make capital calls that protect liquidity and drive profit.

- Control the boardroom narrative with confidence & credibility.

- Become the CEO who scales the business and grows shareholder value.

The program already started Join the Waitlist!

When a CEO can't see the financial consequences of decisions clearly, scaling turns into exposure.

And the numbers are unforgiving. Around 50% of businesses don't survive past 5 years. Nearly two-thirds don't make it to 10 years.

Not because the CEO didn't work hard.

Because complexity grows faster than financial control.

Most CEOs think finance is covered. You have a CFO, reports, a budget, maybe a forecast. But as you scale:

- Budgets don't drive execution.

- Capital gets deployed on instinct, not disciplined trade-offs.

- Cash tightens without a clear roadmap.

- Your CFO is buried in reporting, not decision support.

- Boards press harder. Lenders hesitate. Opportunities slip.

This is where scaling breaks: not at strategy, but at financial leadership at the CEO level.

The CEO Financial Intelligence Program is the answer. A focused, CEO-level program to regain control of your numbers, your decisions, and your business.

It’s a live, 6-week online cohort built for CEOs who can’t afford to delegate financial leadership when the stakes are high.

You’ll build the CEO operating system behind better decisions: how cash actually moves through your business, where risk hides before it shows up, and which capital moves create real enterprise value.

You’ll leave with the frameworks to set decision rules, pressure-test investments, and lead board, lender, and investor conversations with credible numbers, not narratives.

You won’t “learn finance.” You’ll build financial leadership at the CEO level.

CEO Financial Intelligence in 60 Minutes

Meet Your Coach

Oana Labes, MBA, CPA

Coach and Founder

Oana Labes is a globally recognized strategic finance expert helping CEOs and CFOs regain control of the numbers that drive decisions — cash, risk, capital allocation, and enterprise value.

She is the founder of Financiario, the autonomous strategic finance system used by mid-market companies to run decision-making with real-time dashboards, forecasts, and board-ready reporting.

She has advised founders, CEOs, and executive teams across industries on capital allocation, financial risk, and value creation—translating complex finance into clear, decision-grade frameworks that hold up under scrutiny from boards, lenders, and investors.

With 450K+ social followers and 150M+ content views, Oana is one of LinkedIn’s biggest voices in corporate finance and is regularly recognized on top-10 U.S. finance influencer lists.

Her courses and coaching programs have helped thousands of leaders strengthen their financial leadership—so they can make better decisions, protect cash, and grow enterprise value with confidence.

Financial Leadership: The CEO’s Superpower or Their Kryptonite

At scale, financial leadership is either your biggest advantage or the weakness that quietly takes you down.

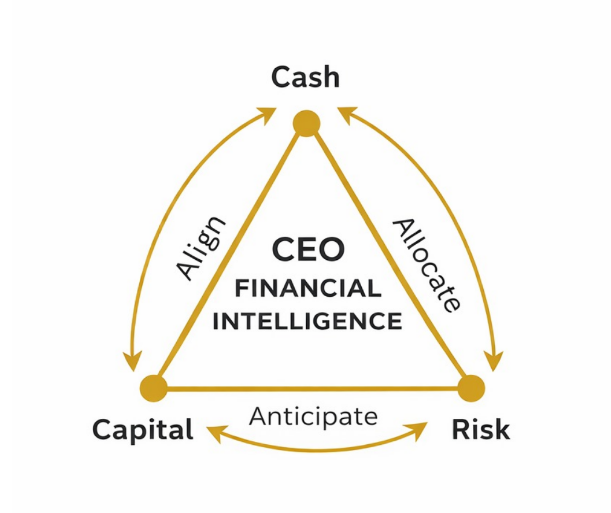

When a CEO can anticipate pressure early, allocate capital with discipline, and own the financial outcome, the company moves faster and cleaner. Decisions hold up. Strategy translates into action. Value compounds.

When a CEO can’t anticipate the financial impact of their business decisions, the same forces become kryptonite. Capital goes to the wrong places or moves too late. Risk shows up after options disappear.

This is exactly what the CEO Financial Intelligence Program is built to change.

It turns financial leadership into a repeatable executive capability—so you develop the foresight, discipline, and authority to allocate capital at scale and lead decisively when it matters most.

Because at the CEO level, financial leadership isn’t optional.

It’s the difference between compounding and collapsing.

What Changes When CEOs Lead with Financial Intelligence

Going through the CEO financial program with Oana was a great experience. It helped me. In our case, we were just introducing a new financial position or financial lead to our team, and we have been able to put together the first 100 day plan. One of the things that it gave us the course is clarity about what to expect, how to build it, the type of analysis, not to go with the simple analysis that one typically makes, but to be able to take a comprehensive look into all the different financial statements, into how everything translates into cash, and be able to be more profound in that analysis.

The insights into knowing your business numbers and balancing the interpretation with the overall Company strategy in a way I had not done in the past is game changing. Put simply, you do not know what you do not know and Oana opened my eyes to a perspective that can only lead to significantly improved results and performance. Her knowledge, experience and commercial competence is incredible and I would highly recommend her courses to any boardroom professional and/or business owner seeking to up their own understanding and positive impact on bottom line results.

Greta Goto

Board Vice Chair

Helping leaders connect finance to strategy.

“The CEO Financial Intelligence Program has been phenomenal. I took finance during my MBA, but what Oana is teaching is leaps and bounds above what I got at that time! This program is targeted specifically to the executive and it really gets to how finance reports fit together with strategy and how to use financials to understand potential issues that can be addressed before they become big problems. Greatly appreciated the program notes and loved the frameworks.”

Troy Kent

President, Kent Power

Turning numbers into faster, clearer decisions.

“I found this to be very insightful and a great extension of my MBA classes. My CFO and I did this together and found tremendous value in going through the program side by side. There was more depth here, with advanced tools we could directly apply to our business. Oana presented the information exceptionally well and kept the sessions engaging throughout. I also appreciated having the recorded classes to revisit the material multiple times. You won’t regret your time in this program.”

Tania Wiese

Finance and Operations Manager

Game changer with incalculable ROI

“CEO Financial Intelligence Program was a game changer — and if you take into account the amount of time it required, versus the quantum leaps in my thinking and confidence, the ROI is incalculable. You were able to get the essence of the concepts across in a way that is simple, yet profound and powerful. I realized that I know more than I thought, but at the same time a new world has opened up for me. I cannot recommend this course strongly enough!”

Jonathan Milner

CEO, Aire Global

Strategic finance for real-world CEOs.

“Oana has a great knack for presenting some pretty obvious-sounding stuff without you feeling stupid for not knowing. This isn't an accounting course, it's strategic finance for real-world business. The volume of tools and leave-behind content, as well as lifetime access, is outstanding. I recommend this course for any budding CEO who wants to level up on the finance side of running a business.”

Andrea Enrico Maria Boin

Partner, PwC

Bridging CFO language and strategy.

“If you want to learn the CFO's language and connect numbers to strategy, starting from your company's vision and mission, The CEO Financial Intelligence program is for you. I found this course very useful for both C-levels and for those working in Deals environments.”

David Dieter

CEO

Optimizing financial fundamentals for growth.

“The CEO Financial Intelligence Program was exceptional! The course is a journey to understand the finance fundamentals, tie them together to optimize how to steer your business to meet your long-range financial goals. A must for all CEOs and business leaders who want to take their game to the next level!”

Warren Bryson

Executive Leader

Clarity, confidence, and better execution.

“I wanted to express my sincere appreciation for the valuable insights, engaging discussions, and high-quality materials provided during the CEO Financial Intelligence Program. The experience was incredibly enriching. I found the course exceptionally valuable and applicable.”

Ryan Shaver

CEO & Business Leader

Structured learning, real-world impact.

“This program was an outstanding investment for me personally and for our business. The curriculum was thoughtfully structured, and Oana’s energy and clarity in delivering complex financial concepts made the learning both engaging and immediately applicable. I gained a much deeper understanding of how to connect financial data to real-world decision-making.”

Claudio De Almeida

Finance and Operations Manager

Enlightening and engaging - much exceeded my expectations!

“The CEO Financial Intelligence Program is a very well-designed program. Not just educational but also engaging, enlightening, practical and exceptionally delivered!”

Bernhard Schaller

Chairman of the Board, Sanador AG

Really Excellent

“The CEO Financial Intelligence Program is really excellent. Good mix of theory and practical cases. Good advanced update to my Global Executive MBA. Thanks a lot that I have the opportunity to learn in your programs and masterclasses.”

Jim Sexton

COO

Most enlightening & superbly delivered

“The CEO Financial Intelligence Program was most enlightening & superbly delivered by a recognized global expert in the area of corporate finance, Oana Labes!!! Anxious to begin applying the powerful knowledge gained in my own businesses. Highly recommend!”

The Program Curriculum

Week 1: Business Valuation

Every CEO and executive needs to understand what their business is worth—and why. This module breaks down the true drivers of business value: not just revenue and profit, but future cash flow potential, risk, capital structure, and leadership strength.

You’ll learn how investors, lenders, and buyers assess companies, and how your financial decisions today impact valuation tomorrow. We’ll demystify concepts like discounted cash flow, EBITDA, and working capital—and show you how to link your business model, growth plan, and capital strategy to real enterprise value.

Too many CEOs focus only on top-line growth or profitability without understanding how value is actually created or destroyed. This module will show you what really matters—and how to use valuation thinking to make smarter decisions.

By the end of this module, you will:

Understand the key drivers of business value and how they apply to your company

Learn how to assess your company through a valuation lens

Identify steps to increase valuation by improving cash flow, reducing risk, and aligning capital decisions with growth

Week 2: Understanding Financial Statements

Financial statements tell the story of your business—if you know how to read them. This module teaches you how to interpret income statements, balance sheets, and cash flow statements so you can ask the right questions, spot red flags, and guide decisions.

You’ll learn what each statement is really telling you, how they connect, and how to move beyond surface-level KPIs to the insights that matter most. No accounting background needed—just practical skills that give you real control over your company’s financial direction.

A CEO doesn’t need to know how to prepare the financials—but they must know how to use them. This module gives you that power.

By the end of this module, you will:

Interpret key financial statements with confidence

Identify financial strengths, weaknesses, and performance patterns

Connect financial results to your business operations and strategy

Week 3: Financial Health & Financial Strength

Growing businesses often look great on paper—but crack under pressure. This module helps you evaluate how resilient and scalable your company really is.

You’ll learn how to assess your company’s financial health across five dimensions: profitability, liquidity, efficiency, solvency, and cash flow. We’ll show you how to stress-test your numbers, identify weak points, and build safety margins that give you the confidence to pursue bold moves.

Financial strength isn’t about having the biggest bank balance. It’s about being positioned to scale, survive, and thrive—no matter what happens. This module gives you the lens and tools to get there.

By the end of this module, you will:

Assess the full financial health of your business using practical tools

Identify and strengthen weak spots before they limit your growth

Build the financial resilience needed to scale with confidence

Week 4: Long-Range Strategic Financial Planning, Forecasts & Budgets

Your past performance is history—what really matters is your ability to plan and perform for the future. In this module, you’ll learn how long-range strategic financial plans are built, how to connect them to your goals, and how to keep your business on track with budgets and rolling forecasts.

We’ll cover how to align your strategy with your numbers, how to make forecasts that reflect reality—not hope—and how to build plans that make funding, expansion, and investor conversations far easier.

CEOs don’t just set targets—they need a financial roadmap to achieve them. This module helps you build that map.

By the end of this module, you will:

Create a 5-year financial plan aligned with your business strategy

Build budgets and forecasts that drive execution and accountability

Use scenario planning to prepare for upside and downside risks

Week 5: Capital Allocation and Performance Management Frameworks

Where you put your money is where your strategy lives. In this module, you’ll learn how to allocate capital—whether it's investing in growth, repaying debt, or distributing to shareholders—and how to track whether those decisions are actually delivering results.

We’ll cover a 5-step capital allocation framework that helps you prioritize what matters most, evaluate ROI, and balance risk and return. You’ll also discover how to implement performance management systems like OKRs, KPIs and scorecards to keep your team focused, engaged and accountable.

This is where financial leadership separates great CEOs from average ones. When you master capital allocation, you unlock the power to scale with precision and purpose.

By the end of this module, you will:

Use a structured framework to allocate capital across competing priorities

Evaluate investments using metrics like NPV, IRR, and Free Cash Flow

Select KPIs and monitor them with dashboards to drive execution and performance

Week 6: Ongoing Management & Strategic Communication

Use strategic storytelling techniques to communicate effectively with your board, investors and also teams. Understand how to work effectively with your CFO and how you can partner with them for ongoing shareholder value creation.

The most effective CEOs don’t just understand the numbers—they know how to communicate them to align teams, influence investors, and build trust. This module shows you how to turn financials into a compelling story that drives action.

You’ll learn strategic storytelling frameworks, how to deliver board-ready insights, and how to lead your executive team using financial intelligence—even if you don’t have a CFO. We’ll also cover how to anticipate risk, adapt in real time, and manage with foresight instead of hindsight.

By the end of this module, you will:

Use financial insights to tell a strategic story and influence decisions

Communicate clearly with boards, lenders, and investors

Lead your company forward using real-time dashboards, dynamic forecasts and effective risk monitoring

Program Investment

Next cohort starts February 11, 2026

For CEOs, the cost of one misallocated capital decision, one liquidity surprise, or one eroded board relationship far exceeds the investment in this program.

This is not tuition.

It's insurance against preventable exposure — and leverage for better decisions.

Add a Team Member

$2,500

Accelerate results by involving your executive team in the program. For every full seat purchased, add a team member at half cost.

Add a Team MemberWho Is This Program For?

CEOs and Board Members

Who want to move beyond surface-level financials and gain real insight into the numbers that drive performance, risk, and long-term value.

C-Suite Executives

Who are navigating the tension between vision and execution—and need sharper financial thinking to support strategic decisions.

Senior Managers

Who are ready to operate at the next level—building the financial acumen and strategic thinking expected in the C-suite.

What Makes This Program Different?

Financial Intelligence Focus

Exclusively focused on strategic financial acumen CEOs need to drive decisions, unlike broader leadership programs that lack financial depth.

CEO-Centric

Approach

Not about becoming your CFO—it's about becoming a CEO who can confidently challenge assumptions, align strategy with resources, and protect value.

Unparalleled Teaching Resources

Delivered using proprietary frameworks that simplify complex financial concepts into practical decision-making tools for immediate implementation.

4 Key Elements of The Program

Weekly Masterclasses

Live, 90-minute masterclasses every Wednesday for 6 weeks

12 PM EST / 5 PM GMTWeekly Q&A

Live Q&A group coaching sessions every Friday for 6 consecutive weeks

12 PM EST / 5 PM GMTFrameworks Toolkit

Exclusive toolkit packed with custom frameworks to help you understand, retain and apply program concepts

Exclusive Community

Get customized answers, solutions and coaching targeted to your individual business challenges.

What’s Included

WORLD CLASS MATERIALS

Financial Leadership Frameworks

Live Sessions

Plus Full Video Recordings.

Professional Slides

Weekly Program Notes

Mobile Access

Learn on-the-go anytime.

Completion Certificate

Value-Packed Bonuses

OVER $13.000 IN BONUSES - 3x THE PROGRAM VALUE

Cash Flow Masterclass

(2.5 hrs on-demand)

Financial Analysis Masterclass

(5.5 hrs on-demand)

10 Essential Cheat Sheets and Checklists

The 15-in-1 Financial Forecast Model

The Dynamic Valuation Model

The Cash to Cash Waterfall

3 Months to Program Community

Complimentary access

Over 65+ Additional materials and Study Guides

Direct Access to Oana

Questions, guidance & insights

Join Leaders from 20 Countries

Wondering how your skills stack up?

Open the score card in a new tab

Frequently Asked Questions

Financial Leadership Is a CEO Responsibility

If you're scaling a business where capital, cash, and credibility matter, financial leadership cannot remain delegated.

This program is where CEOs step into that responsibility — deliberately and decisively.

Join the Waitlist

Transform Your Leadership Today.

Earn Your Prestigious Completion Certificate

Showcase your achievement with our elegant, professional certificate upon program completion.

Display it proudly in your office or add it to your LinkedIn profile to enhance your professional credibility.

Join the elite network of financial leaders who have elevated their financial leadership skills with The CEO Financial Intelligence Program.

Join the Waitlist